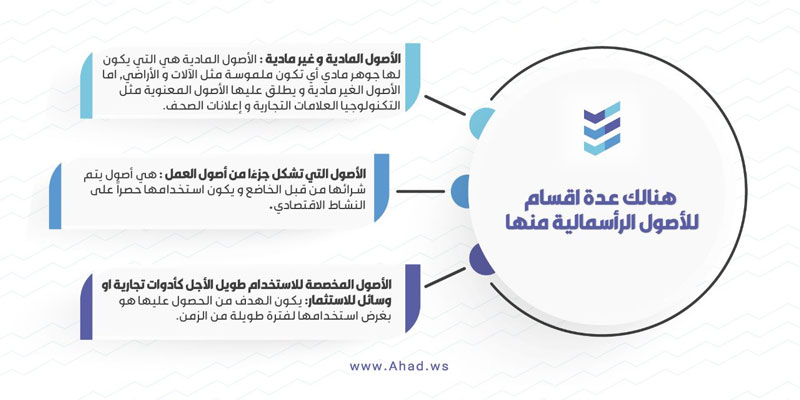

Capital assets are defined as tangible and intangible assets that are part of a business’s assets and are intended for long-term use as a tool or investment.

Generally, owning capital assets aims to generate revenues for the entity.

However, there are several categories that belong to the property subject to taxation, and they are part of the business activity assets, but they are not considered capital assets, such as:

- Inventory: Goods traded.

- Raw materials used in manufacturing and production.

- Consumables.

- Low-value items such as office supplies.

Legislation exempts damaged, stolen, or lost goods from taxation, as they are deemed hypothetical supplies and are therefore not subject to value-added tax, provided they meet the conditions and requirements set by the authority.

The authority may request evidence of damage, theft, or loss of goods through a report from the police or a certificate from the insurance company.