Taxable persons are entitled to deduct the VAT on inputs they incurred (paid) before the registration effective date for VAT purposes. Depending on the case, this applies to goods and services received for the purpose of use within the context of economic activity (up to the extent that enables them to carry out taxable supplies, intermediary supplies, and supplies that would have been taxable if they had occurred in the Kingdom).

The right to deduct VAT on inputs paid before the registration effective date is subject to specific conditions and standards.

The Unified VAT Agreement stipulates the following conditions regarding the deduction of VAT on inputs paid before the registration date:

Receipt of goods and services for the purpose of making taxable supplies.

Non-consumption of capital assets entirely before the registration date.

Non-supply of goods before the registration date.

Receipt of services within a certain period before the registration date as determined by each member state.

The goods and services should not be subject to any restrictions associated with the right to deduction as stipulated in this agreement.

Taxable persons are entitled to deduct VAT on inputs incurred regarding services provided to them during the six months preceding the registration effective date, provided that:

The services are purchased for the purpose of use within the context of economic activity.

The services have not been supplied to another person and have not been fully used by the taxable person before the registration date.

The services are not of a restricted type for deduction. (Guidance Manual “Input Tax Deduction”)

Taxpayers are not required to adjust input tax deduction in case of loss, damage, or theft of goods.

To prevent fraud attempts and eliminate doubts, the Executive Regulations included a provision stating that the taxpayer must declare goods that were lost, damaged, or stolen in the same manner as declared in their accounting records and books to prove and support the input tax deduction for those goods.

The authority may request additional evidence related to loss, damage, or theft, including, for example, a police report and insurance documents.

Example: In August 2020, Al-Hussam Mechanical Works Company purchased (50) car light bulbs for use in car repairs at a price of (50) Saudi Riyals per unit – excluding VAT. The total purchase amounted to 2,875 Saudi Riyals (2,500 + 375 VAT). Two weeks later, an employee accidentally dropped a set of bulbs, rendering them unusable. There was no insurance on these units.

The company recorded them as damaged goods after approval from the management in its accounting books. Therefore, Al-Hussam Company can deduct the VAT (375 Riyals) imposed on the purchase of the damaged units in the tax return. (Guidance Manual “Input Tax Deduction”)

This includes cases where the consideration for the supplier has not yet become due (for example, if an additional grace period is granted for payment). When the customer pays for the supply, they can then deduct the input tax in the period of payment.

In other cases, when the taxable person does not receive full or partial consideration related to a taxable supply, the taxable person, as the supplier, under certain conditions, is entitled to reduce the output tax for this supply. This is known as bad debt relief.

The adjustment of deductible input tax by the customer is not linked to the supplier’s entitlement to bad debt relief.

The Unified VAT Agreement states that “the announced price in the local market for goods and services must include VAT.” This means that prices advertised to the public must include the value-added tax (VAT), such as in retail stores.

Most professional services are provided as business-to-business transactions, where the authority agrees that the supplier and the customer agree on a price excluding VAT or in exchange for the amount due for the supply of goods and services. In these cases, the agreement between them must clarify that the price does not include VAT. If the price is listed without mentioning VAT, it will be assumed that the amount includes VAT.

In such cases, or if the agreement includes another formulation that specifies the inclusion of VAT (such as “inclusive of all taxes”), the VAT due from the supplier is calculated as 15/115 of the total consideration payable.

The Unified Agreement defines the term “consideration” as follows:

“Everything received or to be received by the taxable supplier from the customer or a third party in return for the supply of goods or services, including VAT.”

Note:

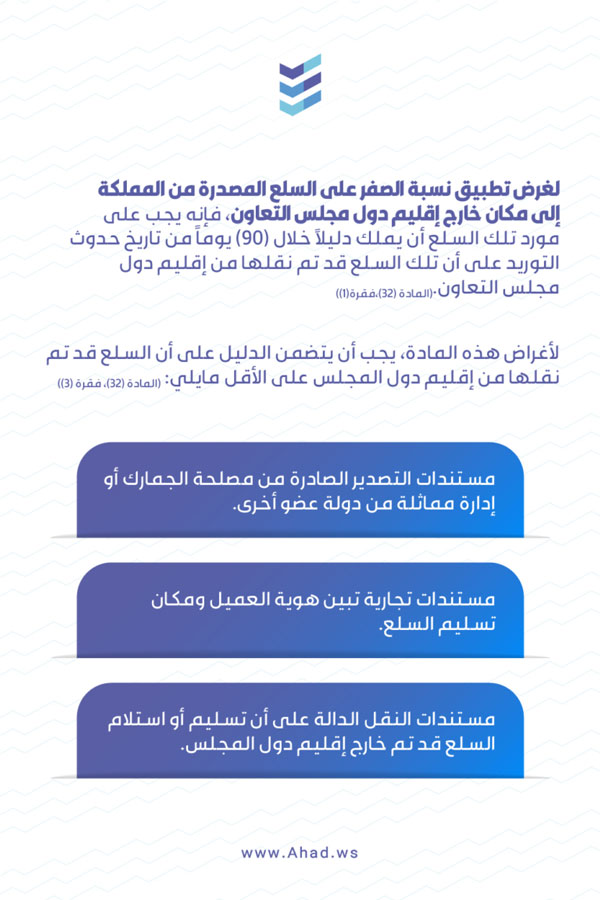

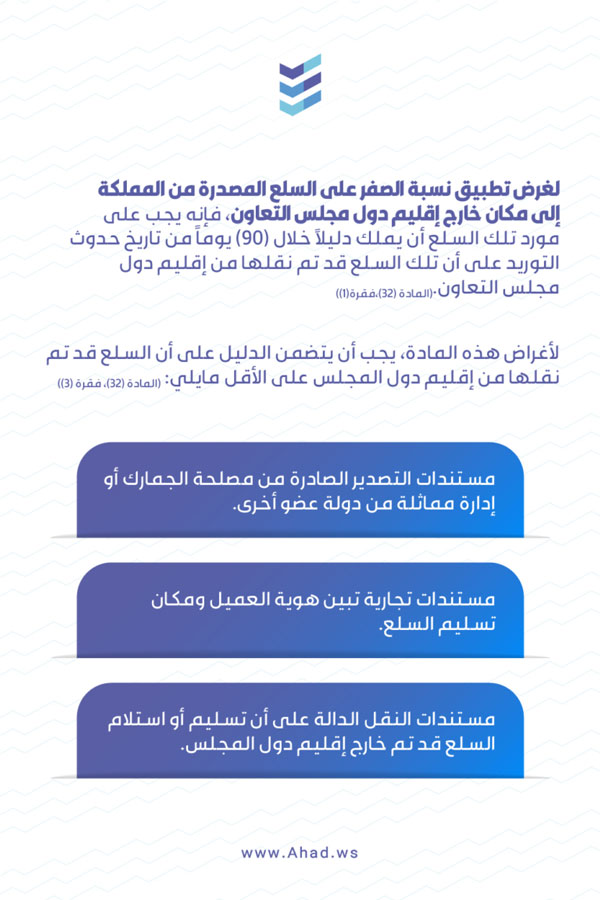

As a transitional phase, any supply involving the movement of goods outside the Kingdom’s territory to one of the GCC countries will be considered as an export subject to a zero-rate.

The movement outside the GCC countries referred to in this section is the movement outside the Kingdom during the transitional phase.

In ordinary cases, export includes:

Completing the export declaration by the exporter as required and specified in the Unified Customs Law system.

Transferring the goods outside the GCC territory.

The export declaration and the transfer of goods are completed either by the supplier as a direct exporter or by the customer as an indirect exporter, which will affect the application of the zero-rate during the supply.

In all cases, the supply is considered as an export if the supplier and the customer intend to move the goods outside the GCC territory as a result of this supply.

“Tax becomes due on the date of supply of goods or services, or the date of issuing the tax invoice, or the date of receipt of consideration, whichever is earlier.”

The date of supply determines the tax period for which the supply will be declared. Since each supply has a different tax due date, VAT is paid by the supplier to the authority when filing the return (when VAT for the entire period is due).

In ordinary cases, the actual date of supply for goods or services is the date of delivery of the goods or completion of the services. However, there are some special rules for determining the date of supply within the Unified VAT Agreement and its Executive Regulation.

Example: Dr. Nora provides medical consultation services. Since medical consultation is a one-time service, the date of supply is the date of the consultation.

Professional events, seminars, and conferences generally involve training, professional development, marketing, promotional activities, or a combination of these for a group of attendees.

These events can span several days and may include, in some cases, the provision of food, accommodation, and cultural events in the host city.

The rules for determining the place of supply have been agreed upon at the level of the Gulf Cooperation Council (GCC) countries through the Unified VAT Agreement. This agreement clarifies the country that should apply VAT in cases of cross-border transactions (where goods move from one country to another, or where the supplier and the customer are residents of different countries).

VAT is levied in the Kingdom of Saudi Arabia on transactions that occur within the Kingdom for VAT purposes. Generally, VAT is applied to transactions where the place of supply is in the Kingdom either at a rate of 15% or 0%. Transactions where the place of supply is outside the Kingdom are not subject to VAT in Saudi Arabia.

The supply of financial services to a resident person in Saudi Arabia is generally exempt from VAT. However, many supplies may be considered taxable based on the type of consideration for these financial services.

The table below summarizes the general principles:

The profit margin is defined as the difference between the purchase price and the selling price. There are conditions to apply the profit margin scheme, which must be met:

The car must be classified as a “Qualified Used Car” by the Authority.

The used car must be registered in the Kingdom.

The taxpayer must be licensed to engage in the trade of cars, according to a commercial register or a similar license.

The person licensed to engage in the trade of cars must obtain approval from the Authority to use the profit margin scheme for used cars.

The taxpayer should not have incurred input tax according to the standard method on the consideration paid when purchasing the qualified used car.

The requirements for tax invoices and record-keeping must be fulfilled according to the provisions of Articles 48 and 53 of the Executive Regulations of the VAT Law.

Conditions for classifying the car as a “Qualified Used Car” include:

The car must have been driven on the road for personal or business purposes.

The car should be suitable for reuse as is, or after some improvements, provided that such improvements do not change the fundamental nature of the car.

For further details, you can refer to the guidance manual issued by the Zakat, Tax, and Customs Authority through the provided link.

The place of supply for any passenger or freight transportation service is where the transportation begins. This rule applies regardless of the supplier’s or the customer’s place of residence, VAT registration status, or the booking method (whether booked in person or through electronic booking services). Therefore, the place of supply for transportation services and the applicable VAT rate remain unchanged irrespective of the aforementioned variations.

For investment metals exports: If investment metals are exported outside the Kingdom, it is considered an export of goods to a location outside the GCC region, which is subject to a zero percent tax rate. The supplier must obtain export documents, commercial invoices, and transportation documents proving that the goods have been transported outside the GCC region.

Investment metals supplies: These are supplies of goods where the supply involves the transfer of ownership or the right to dispose of specified chips, alloys, plates, or other identified or pieces of investment metals.

However, many transactions related to investment metals may not involve the transfer of ownership of those metals. Leasing or selling investment metals on a “generic” (non-specific) basis is allowed.

When metals are sold on this basis, the buyer has the right to possess a certain quantity of metals, and this quantity remains in the possession of the supplier. However, the buyer does not acquire ownership of any specific tangible goods. Therefore, sales of investment metals on a “generic” basis and their leasing are treated as supplies of services for VAT purposes.

Gold, silver, and platinum supplies in the Kingdom are subject to a zero percent tax rate. The zero percent rate applies to direct and explicit sales of investment metals, as well as any other form, including:

“Grants, waivers, or abandonment of any right, interest, or claim to any supply of investment metal if that right, interest, or claim constitutes a transfer of ownership of the goods or grants a right to it.”

Value Added Tax (VAT) is imposed at the place where goods or services are consumed, with the place of supply determining whether VAT will be levied or not.

VAT should not be imposed on any goods or services that will be consumed or enjoyed outside the Kingdom of Saudi Arabia, in line with the principles of territoriality and consumption.

The tax is imposed on supplies of goods and services subject to tax that are supplied within the Kingdom by persons subject to tax. If the customer consumes or enjoys these services or goods outside the Kingdom, they may request a refund of the tax incurred from the authority.

It is a mechanism by which the VAT-registered customer becomes liable for the VAT instead of the supplier, and is responsible for all obligations stipulated in the agreement and local law.

The reverse charge mechanism is applied only to services received by a VAT-registered customer from a non-resident supplier in the GCC region, which are inherently subject to VAT.

There are several examples of services subject to VAT under the reverse charge mechanism, such as:

Legal and consultancy services

Subscription and membership services

Advertising services

One of the fundamental factors contributing to differences in tax advice is the advisor’s previous experience and the various cases they have encountered or been involved in. An expert who has worked in the field for many years and has a deep understanding of tax law may have a different perspective on a particular issue than someone lacking sufficient experience in the profession. Additionally, different tax experts may specialize in different areas, leading to variations in advice.

Another factor affecting tax advice is the specific context of the tax issue. For example, the tax implications of a particular transaction may vary depending on the economic activity of the taxpayer or the jurisdiction where the transaction takes place. As a result, tax experts may provide different advice based on the changing circumstances of each situation and each client.

Differences in the interpretation of tax laws and regulations can also contribute to variations in tax advice. Tax law is complex and subject to frequent changes and updates. Different tax experts may have different interpretations of specific provisions or regulations. Moreover, the application of tax laws and regulations can depend on various factors, such as the tax liability structure, the nature of the transaction, and the timing of the transaction, all of which can affect the advice provided by the tax expert.

Selecting a tax advisor is a crucial decision for individuals and businesses. Here are some key factors to consider when choosing a tax advisor:

Qualifications: Look for a tax advisor with appropriate qualifications, such as a VAT specialist, or one who holds the Saudi Organization for Certified Public Accountants (SOCPA) accreditation or Certified Public Accountant (CPA) designation. These professionals have undergone rigorous education and training in tax law and adhere to high ethical standards.

Experience: Consider the level of experience of the tax advisor in a specific area of tax law where you need assistance. For example, if you are a small business owner, you may want to work with a tax expert who has experience working with small or medium-sized enterprises.

Reputation: Research the tax advisor’s reputation and track record. Look for reviews and testimonials from previous clients, and check to see if the tax advisor has any disciplinary actions or complaints filed against them.

Communication Skills: Choose a tax advisor who communicates clearly and effectively and is able to explain complex tax concepts in a way you can understand. You want to work with someone responsive and available to answer your questions.

Fees: Ensure the tax advisor’s fees are reasonable for your financial situation.

Compatibility: Finally, choose a tax advisor you feel comfortable working with, who understands your needs and goals and can provide customized guidance tailored to your business and circumstances.

In conclusion, it’s important to recognize that tax advice can vary from one expert to another, and there may not always be a “right” or “wrong” answer. When seeking tax advice, it’s important to work with a reputable and experienced tax specialist who can provide tailored guidance based on your business needs and individual circumstances.

In general, individuals or entities engaged in continuous and regular economic activities must register for Value Added Tax (VAT) purposes. Registration is optional if their taxable supplies or expenses exceed SAR 187,500 during a twelve-month period, and mandatory if the total taxable supplies exceed SAR 375,000 during the same period. They are also required to collect VAT on their activities and remit it to the General Authority of Zakat and Tax (GAZT).

When Should Taxpayers Submit Their Tax Returns?

Monthly tax returns must be filed by VAT-registered persons whose annual supplies exceed SAR 40 million, due on the last day of the month following the end of the economic activity.

Quarterly tax returns are filed by VAT-registered persons whose annual supplies are less than SAR 40 million, with the first quarter due on April 30.

What Are the Penalties for Late Filing or Payment?

Failure to submit tax returns on time incurs a penalty of 5% to 25% of the tax due.

Failure to pay the tax on time incurs a penalty of 5% of the tax due for each month or part thereof.

After filing the tax return, the taxpayer receives three correspondences via email or mobile number:

- Acknowledgment of Tax Return Receipt.

- Received Tax Return Form.

- Invoice Notice for Payment.

Furthermore, FAI offers you the ability to prepare your tax return and archive it in the system, allowing you to efficiently manage your tax obligations!

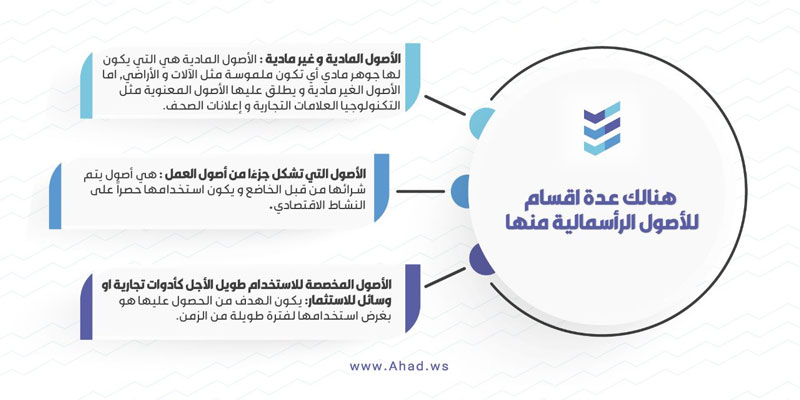

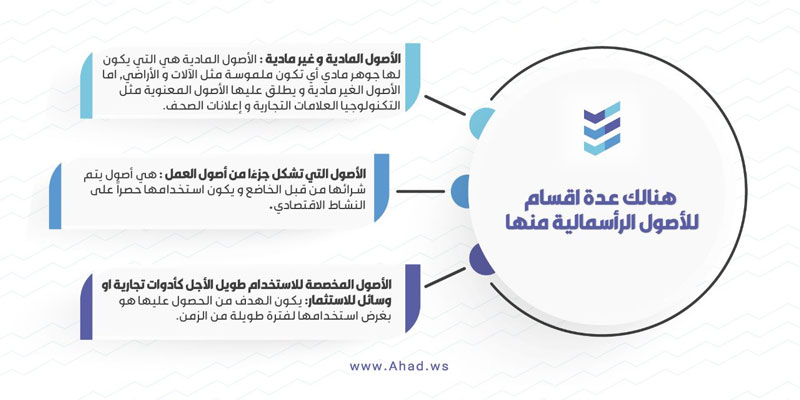

Capital assets are defined as tangible and intangible assets that are part of a business’s assets and are intended for long-term use as a tool or investment.

Generally, owning capital assets aims to generate revenues for the entity.

However, there are several categories that belong to the property subject to taxation, and they are part of the business activity assets, but they are not considered capital assets, such as:

- Inventory: Goods traded.

- Raw materials used in manufacturing and production.

- Consumables.

- Low-value items such as office supplies.

Legislation exempts damaged, stolen, or lost goods from taxation, as they are deemed hypothetical supplies and are therefore not subject to value-added tax, provided they meet the conditions and requirements set by the authority.

The authority may request evidence of damage, theft, or loss of goods through a report from the police or a certificate from the insurance company.

Over-declaration of the due tax:

If the tax return results in an increase in the amount of tax payable, such as declaring an increase in output tax or a decrease in input tax, the taxpayer may correct the error in any subsequent tax return within the specified adjustment period.

If the error is SAR 5,000 or less, it can be adjusted in the subsequent tax return. However, if the error exceeds SAR 5,000, the taxpayer may make the necessary correction in the next return by adjusting the tax amounts in the fields corresponding to the ones incorrectly filled, by either reducing the output tax or increasing the input tax.

Under-declaration of the due tax:

If the taxpayer discovers that the tax was declared to the authority in an amount less than the tax due, resulting from under-declaring output tax and overstating input tax, they must notify the authority within twenty days of becoming aware of the error or the incorrect amount declared in their original tax return submitted to the authority. This notification can be made by submitting an electronic correction to the previous return for the period associated with the assessments that have been corrected.

To begin with, let’s define Value Added Tax (VAT) as a non-direct tax imposed on goods and services purchased and sold by taxable entities. There are three types of Value Added Tax applied in the Kingdom of Saudi Arabia:

Standard Rate Value Added Tax: 15%

Zero-Rate Value Added Tax: 0%

Exempt Value Added Tax (“Exempt Sales”)

Zero-Rate Tax:

This tax is imposed at a zero rate according to legal provisions, and its rate can be increased at any time without amending the law. Examples include:

Qualified medicines and medical equipment.

Investment metals.

Goods exported outside the Gulf Cooperation Council (GCC) countries.

International transportation services for goods and passengers.

Exempt Tax:

Exempt Value Added Tax (“Exempt Sales”) is an exemption from Value Added Tax for some goods and services provided within the Kingdom of Saudi Arabia. If there is any adjustment to the taxable value of the exempted goods and services, a legal provision is required to modify it to any percentage to which the amendment is made.

Examples of exempted sales from Value Added Tax include:

Life insurance.

Financial services where the consideration is in the form of implicit or explicit margin (e.g., interest on loans).

Issuance or transfer of debt or capital bonds.

Personal luggage and used household items brought in by non-resident citizens or foreigners coming to reside in the country for the first time.

Rental of residential units.

It’s worth noting that any exempt services within the territory of the Kingdom of Saudi Arabia that are exported abroad are subject to a zero-rate. Thus, the supplier or taxpayer has the right to deduct the input tax on these supplies.

For example, providing life insurance services within the Kingdom of Saudi Arabia is exempt from tax, but if this service is provided to a non-resident individual in the Kingdom, it is subject to a zero-rate. (Article 31, Paragraph 2)

In conclusion, one of the most significant differences between zero-rated and exempt VAT is that the zero-rate does not require a legal provision to change its rate, while the exempt VAT requires a legal provision to change it to be subject to VAT regardless of the rate. Additionally, all goods and services subject to the zero-rate can have their input tax deducted, while exempt services and goods cannot.

Deemed supply occurs when a supplier indicates that goods or services have been supplied, even if no consideration has been received for these goods or services. In such cases, the tax is imposed on this deemed supply, even if the taxable person has not received any payment for these goods or services. However, the taxable person does not have the right to waive the state’s right to this tax.

Deemed supply tax is imposed when the taxable person has claimed input tax on these goods or services.

The following actions by the taxable person are considered deemed supplies:

- Disposal of goods for purposes other than business, whether with or without consideration.

- Changing the use of goods to make supplies that are not subject to tax.

- Retaining goods after business activities have ceased.

- Supplying goods without consideration, unless the supply is within the context of business, such as providing samples or low-value gifts.

- Using goods that form part of personal assets for personal use.

- Supplying services without consideration.

If the taxable person has deducted only part of the input tax when purchasing goods and services or when importing goods directly related to any deemed supply, the value of the deemed supply will be adjusted to reflect the relative value of the input tax deducted.

There are also supply scenarios exempted by VAT legislation, which are considered non-deemed supplies and are not subject to tax under the following conditions:

- If a taxable person provides gifts and samples to promote their economic activity, provided that the fair market value of each gift or sample does not exceed SAR 200 (excluding VAT) per person per calendar year. Also, intra-group supplies are ignored, as they are treated as a single entity, and thus, cannot supply to themselves. Therefore, supplies between members of the tax group fall outside the scope of VAT.

- Similarly, if the taxable person provides gifts to their employees, provided that the value of each gift does not exceed SAR 200 (excluding VAT) per person per calendar year, and the total value of gifts and samples for the calendar year does not exceed SAR 50,000 based on the fair market value.

Furthermore, damaged, stolen, or lost goods are exempted from VAT, as they are deemed non-supplies. However, to be exempted, they must meet the conditions set by the authority, and the authority may request a report from the police or an insurance company to prove the damage, theft, or loss.

A tax invoice is defined as a document issued for taxable supplies, according to the requirements stipulated in the regulations.

Previously, tax invoices were manually issued or generated from any software such as Word or Excel. However, the General Authority of Zakat and Tax (GAZT) announced the approval of the Electronic Invoicing Regulation, and the obligation to issue and maintain invoices electronically starting from December 4, 2021.

We will discuss the definition of electronic tax invoices (standard) and simplified electronic invoices, and the difference between them.

- Electronic Tax Invoice (Standard):

- This invoice is issued from one entity to another and contains all the elements of a tax invoice, including:

- Document title: “Tax Invoice” or “Simplified Tax Invoice.”

- Dates: Invoice issuance date and the date of supply if different from the issuance date.

- Serial number of the tax invoice.

- Supplier’s details: Name, address, VAT registration number.

- Customer’s details: Name, address, VAT registration number.

- Details of the supply: Must be in Arabic; other languages are allowed alongside Arabic.

- Total amount before VAT.

- VAT rate.

- Total amount after VAT.

- Simplified Tax Invoice:

- This invoice is issued for supplies subject to VAT in specific cases and contains fewer details compared to the standard tax invoice.

- It is usually issued from an entity to an individual (non-taxable persons) and must contain a Quick Response (QR) Code.

- Note that it has become mandatory to apply the QR Code on standard tax invoices starting from January 1, 2023, which is the second phase of electronic invoicing.

These tax invoices ensure compliance with VAT regulations and facilitate the process of taxation and financial record-keeping for businesses.

If you are a taxpayer subject to value-added tax (VAT), you must know what obligations and conditions you are required to comply with. Here are the most important obligations stipulated in the regulations:

-

- Issuing Invoices:

- Every person subject to VAT must issue a tax invoice, whether it’s a simplified invoice or a full invoice, for every taxable supply to both taxable and non-taxable persons. Invoices must be issued according to the requirements set by the authority. (Article 53)

- Submitting VAT Returns:

- Every registered person for VAT purposes, and anyone representing a VAT taxpayer, must submit their tax return for supplies and expenses during the tax period, whether monthly or quarterly (every three months).

- The tax return is a self-assessment by the person for their supplies and expenses, determining the amount they owe or are owed by the authority, and refund requests can be made within five years.

- The return must be submitted and the tax paid by the last day of the month following the end of the tax period. (Article 62)

- Maintaining Records:

- All persons subject to VAT must keep tax records related to calculating VAT for auditing purposes and for inspection and review by authority employees if necessary. This includes any documents used to determine the VAT amount for each tax return.

- Records must be kept for the basic retention period of six years. (Article 66)

- Displaying VAT Registration Certificate:

- A person subject to VAT and registered with the authority in the VAT system must display their registration certificate at their main place of business and all branches where it is visible to the public. (Article 8-8)

- Correcting Previous Errors:

- If a taxpayer discovers an error in their tax return, the incorrectness of the amount stated in the return, or a failure to comply with any tax obligation, they must inform the authority and correct the error by amending the tax return.

- If the error results in a tax difference of more than SAR 15,000, the taxpayer must inform the authority within 20 days of discovering the error and amend the previous return.

- If it’s less than SAR 15,000, the error can be corrected by adjusting the net tax in the previous return. (Article 63)

- Issuing Invoices:

For example: If a resident pays a fee to a non-resident on February 19th, the person responsible for withholding tax must submit a statement to the authority and pay the withheld tax by March 10th. They must also provide the beneficiary with a certificate showing the amount paid to them and the tax withheld from it.

In addition to the monthly withholding statement and tax payment, the taxpayer must submit an annual statement within a deadline not exceeding 120 days from the end of the fiscal year.

Tax is withheld on each type of income at a specific rate determined by the authority, and the taxpayer must specify the type of income in order to determine the tax withholding rate.

Withholding tax, also known as retention tax, is a direct tax determined at certain rates and applied to non-residents in Saudi Arabia. It is deducted from amounts they receive from a source within the Kingdom. Withholding tax rates in Saudi Arabia range between 5 and 20 percent.

Who is responsible for withholding tax?

The person responsible is defined as any individual residing in Saudi Arabia, whether taxable or non-taxable, or a permanent establishment for non-residents who pays amounts from sources within the Kingdom to non-residents. Thus, they are responsible for remitting the withholding tax amount to the authority.

As for the resident natural person, they are only obligated to withhold tax in cases where they pay an amount from a source within the Kingdom for services provided by a non-resident for the purposes of their economic activity.

A taxpayer whose annual supplies do not exceed 40 million Saudi Riyals may apply to the authority to use a monthly tax period, and the authority may approve or reject it.

Similarly, a person who has used the monthly period for two years may apply to the authority to use a quarterly tax period, provided that the value of their supplies during the year does not exceed 40 million Saudi Riyals at the time of application.

A person using the monthly period submits their first return to the authority at the end of the month following the month of supply. For example, they would submit the tax return for January on February 28.

As for a person using the quarterly period, they submit their first return to the authority on the last day of the month following the three-month period of supply. For example, they would submit the tax return for the first quarter of the year on April 30.

If you are a natural or legal person, engaged in economic activity, and conduct your activity on a continuous and regular basis with the aim of generating income, then you are subject to the regulations and legislation of Value Added Tax (VAT) in Saudi Arabia. There are two types of registration: mandatory and optional.

Optional Registration:

The legislation allows individuals or entities whose supplies or expenses in the past twelve months or expected in the next twelve months exceed 375,000 Saudi Riyals, with an increase of more than 187,500 Saudi Riyals, to optionally register for VAT purposes. Also, those whose supplies consist entirely of zero-rated items are allowed to register optionally. The registration becomes effective from the date of acceptance of the registration application by the authority.

Mandatory Registration:

Registration becomes mandatory for anyone who supplies goods and services subject to VAT, provided that their supplies of taxable goods or services during the past twelve months or expected in the next twelve months reach the mandatory registration threshold of 375,000 Saudi Riyals. Registration must be done within 30 days from the end of the month in which the supplies reach the mandatory threshold, and the registration becomes effective from the beginning of the first month in which the supplies are expected to exceed the mandatory registration threshold.

Taxable persons are entitled to deduct the VAT on inputs they incurred (paid) before the registration effective date for VAT purposes. Depending on the case, this applies to goods and services received for the purpose of use within the context of economic activity (up to the extent that enables them to carry out taxable supplies, intermediary supplies, and supplies that would have been taxable if they had occurred in the Kingdom).

The right to deduct VAT on inputs paid before the registration effective date is subject to specific conditions and standards.

The Unified VAT Agreement stipulates the following conditions regarding the deduction of VAT on inputs paid before the registration date:

Receipt of goods and services for the purpose of making taxable supplies.

Non-consumption of capital assets entirely before the registration date.

Non-supply of goods before the registration date.

Receipt of services within a certain period before the registration date as determined by each member state.

The goods and services should not be subject to any restrictions associated with the right to deduction as stipulated in this agreement.

Taxable persons are entitled to deduct VAT on inputs incurred regarding services provided to them during the six months preceding the registration effective date, provided that:

The services are purchased for the purpose of use within the context of economic activity.

The services have not been supplied to another person and have not been fully used by the taxable person before the registration date.

The services are not of a restricted type for deduction. (Guidance Manual “Input Tax Deduction”)

Taxpayers are not required to adjust input tax deduction in case of loss, damage, or theft of goods.

To prevent fraud attempts and eliminate doubts, the Executive Regulations included a provision stating that the taxpayer must declare goods that were lost, damaged, or stolen in the same manner as declared in their accounting records and books to prove and support the input tax deduction for those goods.

The authority may request additional evidence related to loss, damage, or theft, including, for example, a police report and insurance documents.

Example: In August 2020, Al-Hussam Mechanical Works Company purchased (50) car light bulbs for use in car repairs at a price of (50) Saudi Riyals per unit – excluding VAT. The total purchase amounted to 2,875 Saudi Riyals (2,500 + 375 VAT). Two weeks later, an employee accidentally dropped a set of bulbs, rendering them unusable. There was no insurance on these units.

The company recorded them as damaged goods after approval from the management in its accounting books. Therefore, Al-Hussam Company can deduct the VAT (375 Riyals) imposed on the purchase of the damaged units in the tax return. (Guidance Manual “Input Tax Deduction”)

As the deductible input tax amount is directly linked to the amount of output tax payable, the customer cannot continue to deduct input tax for supplies received if the supply’s value is not fully paid. Specifically, the Executive Regulations included the following: “If a taxable person deducts input tax for a supply received and has not fully paid after a period of twelve months from the date of supply, the input tax deduction must be reduced by the amount of tax calculated on the remaining unpaid consideration on that date.”

This includes cases where the consideration for the supplier has not yet become due (for example, if an additional grace period is granted for payment). When the customer pays for the supply, they can then deduct the input tax in the period of payment.

In other cases, when the taxable person does not receive full or partial consideration related to a taxable supply, the taxable person, as the supplier, under certain conditions, is entitled to reduce the output tax for this supply. This is known as bad debt relief.

The adjustment of deductible input tax by the customer is not linked to the supplier’s entitlement to bad debt relief.

The Unified VAT Agreement states that “the announced price in the local market for goods and services must include VAT.” This means that prices advertised to the public must include the value-added tax (VAT), such as in retail stores.

Most professional services are provided as business-to-business transactions, where the authority agrees that the supplier and the customer agree on a price excluding VAT or in exchange for the amount due for the supply of goods and services. In these cases, the agreement between them must clarify that the price does not include VAT. If the price is listed without mentioning VAT, it will be assumed that the amount includes VAT.

In such cases, or if the agreement includes another formulation that specifies the inclusion of VAT (such as “inclusive of all taxes”), the VAT due from the supplier is calculated as 15/115 of the total consideration payable.

The Unified Agreement defines the term “consideration” as follows:

“Everything received or to be received by the taxable supplier from the customer or a third party in return for the supply of goods or services, including VAT.”

Your Content Goes HereThe export of goods outside the Gulf Cooperation Council (GCC) territory is subject to a zero-rate of Value Added Tax (VAT).

Note:

As a transitional phase, any supply involving the movement of goods outside the Kingdom’s territory to one of the GCC countries will be considered as an export subject to a zero-rate.

The movement outside the GCC countries referred to in this section is the movement outside the Kingdom during the transitional phase.

In ordinary cases, export includes:

Completing the export declaration by the exporter as required and specified in the Unified Customs Law system.

Transferring the goods outside the GCC territory.

The export declaration and the transfer of goods are completed either by the supplier as a direct exporter or by the customer as an indirect exporter, which will affect the application of the zero-rate during the supply.

In all cases, the supply is considered as an export if the supplier and the customer intend to move the goods outside the GCC territory as a result of this supply.

Each tax invoice issued for a taxable supply must include the date of supply (tax point date for VAT purposes). The date of supply determines when VAT becomes due, according to the Unified VAT Agreement:

“Tax becomes due on the date of supply of goods or services, or the date of issuing the tax invoice, or the date of receipt of consideration, whichever is earlier.”

The date of supply determines the tax period for which the supply will be declared. Since each supply has a different tax due date, VAT is paid by the supplier to the authority when filing the return (when VAT for the entire period is due).

In ordinary cases, the actual date of supply for goods or services is the date of delivery of the goods or completion of the services. However, there are some special rules for determining the date of supply within the Unified VAT Agreement and its Executive Regulation.

Example: Dr. Nora provides medical consultation services. Since medical consultation is a one-time service, the date of supply is the date of the consultation.

Professional events, seminars, and conferences generally involve training, professional development, marketing, promotional activities, or a combination of these for a group of attendees.

These events can span several days and may include, in some cases, the provision of food, accommodation, and cultural events in the host city.

The rules for determining the place of supply have been agreed upon at the level of the Gulf Cooperation Council (GCC) countries through the Unified VAT Agreement. This agreement clarifies the country that should apply VAT in cases of cross-border transactions (where goods move from one country to another, or where the supplier and the customer are residents of different countries).

VAT is levied in the Kingdom of Saudi Arabia on transactions that occur within the Kingdom for VAT purposes. Generally, VAT is applied to transactions where the place of supply is in the Kingdom either at a rate of 15% or 0%. Transactions where the place of supply is outside the Kingdom are not subject to VAT in Saudi Arabia.

Financial services encompass a wide range of financial products provided to both VAT-registered customers and non-registered customers.

The supply of financial services to a resident person in Saudi Arabia is generally exempt from VAT. However, many supplies may be considered taxable based on the type of consideration for these financial services.

The table below summarizes the general principles:

The rules regarding the place of supply determine which country has the right to apply Value Added Tax (VAT) on the supply of financial services. If VAT is due (i.e., the supply is not exempt), these rules also determine who is responsible for reporting VAT.

Residence of the Supplier or Customer:

In many cases, the rules regarding the place of supply refer to the residence of the supplier and the customer.

The term “resident” includes a company established under the laws of the Kingdom of Saudi Arabia or if its actual management center is in the Kingdom of Saudi Arabia. If a company or any other legal entity is established outside the Kingdom of Saudi Arabia and has a place of business or any other form of fixed establishment in the Kingdom of Saudi Arabia, then that company is considered a resident within the Kingdom of Saudi Arabia.

Starting from July 1, 2023, the application of the profit margin scheme began, allowing the taxable person licensed to engage in the trade of used cars to apply the profit margin scheme to qualified cars after obtaining approval from the Authority. This means that tax is applied only on the profit margin instead of the entire amount.

The profit margin is defined as the difference between the purchase price and the selling price. There are conditions to apply the profit margin scheme, which must be met:

The car must be classified as a “Qualified Used Car” by the Authority.

The used car must be registered in the Kingdom.

The taxpayer must be licensed to engage in the trade of cars, according to a commercial register or a similar license.

The person licensed to engage in the trade of cars must obtain approval from the Authority to use the profit margin scheme for used cars.

The taxpayer should not have incurred input tax according to the standard method on the consideration paid when purchasing the qualified used car.

The requirements for tax invoices and record-keeping must be fulfilled according to the provisions of Articles 48 and 53 of the Executive Regulations of the VAT Law.

Conditions for classifying the car as a “Qualified Used Car” include:

The car must have been driven on the road for personal or business purposes.

The car should be suitable for reuse as is, or after some improvements, provided that such improvements do not change the fundamental nature of the car.

For further details, you can refer to the guidance manual issued by the Zakat, Tax, and Customs Authority through the provided link.

The place of supply for any passenger or freight transportation service is where the transportation begins. This rule applies regardless of the supplier’s or the customer’s place of residence, VAT registration status, or the booking method (whether booked in person or through electronic booking services). Therefore, the place of supply for transportation services and the applicable VAT rate remain unchanged irrespective of the aforementioned variations.

For investment metals exports: If investment metals are exported outside the Kingdom, it is considered an export of goods to a location outside the GCC region, which is subject to a zero percent tax rate. The supplier must obtain export documents, commercial invoices, and transportation documents proving that the goods have been transported outside the GCC region.

Investment metals supplies: These are supplies of goods where the supply involves the transfer of ownership or the right to dispose of specified chips, alloys, plates, or other identified or pieces of investment metals.

However, many transactions related to investment metals may not involve the transfer of ownership of those metals. Leasing or selling investment metals on a “generic” (non-specific) basis is allowed.

When metals are sold on this basis, the buyer has the right to possess a certain quantity of metals, and this quantity remains in the possession of the supplier. However, the buyer does not acquire ownership of any specific tangible goods. Therefore, sales of investment metals on a “generic” basis and their leasing are treated as supplies of services for VAT purposes.

Gold, silver, and platinum supplies in the Kingdom are subject to a zero percent tax rate. The zero percent rate applies to direct and explicit sales of investment metals, as well as any other form, including:

“Grants, waivers, or abandonment of any right, interest, or claim to any supply of investment metal if that right, interest, or claim constitutes a transfer of ownership of the goods or grants a right to it.”

Value Added Tax (VAT) is imposed at the place where goods or services are consumed, with the place of supply determining whether VAT will be levied or not.

VAT should not be imposed on any goods or services that will be consumed or enjoyed outside the Kingdom of Saudi Arabia, in line with the principles of territoriality and consumption.

The tax is imposed on supplies of goods and services subject to tax that are supplied within the Kingdom by persons subject to tax. If the customer consumes or enjoys these services or goods outside the Kingdom, they may request a refund of the tax incurred from the authority.

It is a mechanism by which the VAT-registered customer becomes liable for the VAT instead of the supplier, and is responsible for all obligations stipulated in the agreement and local law.

The reverse charge mechanism is applied only to services received by a VAT-registered customer from a non-resident supplier in the GCC region, which are inherently subject to VAT.

There are several examples of services subject to VAT under the reverse charge mechanism, such as:

Legal and consultancy services

Subscription and membership services

Advertising services

Tax advice can vary from one expert to another due to several reasons, stemming from key factors that can influence the advice provided, such as the advisor’s previous experiences and expertise, the specific context of the tax issue, and differences in interpretation of tax laws and regulations.

One of the fundamental factors contributing to differences in tax advice is the advisor’s previous experience and the various cases they have encountered or been involved in. An expert who has worked in the field for many years and has a deep understanding of tax law may have a different perspective on a particular issue than someone lacking sufficient experience in the profession. Additionally, different tax experts may specialize in different areas, leading to variations in advice.

Another factor affecting tax advice is the specific context of the tax issue. For example, the tax implications of a particular transaction may vary depending on the economic activity of the taxpayer or the jurisdiction where the transaction takes place. As a result, tax experts may provide different advice based on the changing circumstances of each situation and each client.

Differences in the interpretation of tax laws and regulations can also contribute to variations in tax advice. Tax law is complex and subject to frequent changes and updates. Different tax experts may have different interpretations of specific provisions or regulations. Moreover, the application of tax laws and regulations can depend on various factors, such as the tax liability structure, the nature of the transaction, and the timing of the transaction, all of which can affect the advice provided by the tax expert.

Selecting a tax advisor is a crucial decision for individuals and businesses. Here are some key factors to consider when choosing a tax advisor:

Qualifications: Look for a tax advisor with appropriate qualifications, such as a VAT specialist, or one who holds the Saudi Organization for Certified Public Accountants (SOCPA) accreditation or Certified Public Accountant (CPA) designation. These professionals have undergone rigorous education and training in tax law and adhere to high ethical standards.

Experience: Consider the level of experience of the tax advisor in a specific area of tax law where you need assistance. For example, if you are a small business owner, you may want to work with a tax expert who has experience working with small or medium-sized enterprises.

Reputation: Research the tax advisor’s reputation and track record. Look for reviews and testimonials from previous clients, and check to see if the tax advisor has any disciplinary actions or complaints filed against them.

Communication Skills: Choose a tax advisor who communicates clearly and effectively and is able to explain complex tax concepts in a way you can understand. You want to work with someone responsive and available to answer your questions.

Fees: Ensure the tax advisor’s fees are reasonable for your financial situation.

Compatibility: Finally, choose a tax advisor you feel comfortable working with, who understands your needs and goals and can provide customized guidance tailored to your business and circumstances.

In conclusion, it’s important to recognize that tax advice can vary from one expert to another, and there may not always be a “right” or “wrong” answer. When seeking tax advice, it’s important to work with a reputable and experienced tax specialist who can provide tailored guidance based on your business needs and individual circumstances.

In general, individuals or entities engaged in continuous and regular economic activities must register for Value Added Tax (VAT) purposes. Registration is optional if their taxable supplies or expenses exceed SAR 187,500 during a twelve-month period, and mandatory if the total taxable supplies exceed SAR 375,000 during the same period. They are also required to collect VAT on their activities and remit it to the General Authority of Zakat and Tax (GAZT).

When Should Taxpayers Submit Their Tax Returns?

Monthly tax returns must be filed by VAT-registered persons whose annual supplies exceed SAR 40 million, due on the last day of the month following the end of the economic activity.

Quarterly tax returns are filed by VAT-registered persons whose annual supplies are less than SAR 40 million, with the first quarter due on April 30.

What Are the Penalties for Late Filing or Payment?

Failure to submit tax returns on time incurs a penalty of 5% to 25% of the tax due.

Failure to pay the tax on time incurs a penalty of 5% of the tax due for each month or part thereof.

After filing the tax return, the taxpayer receives three correspondences via email or mobile number:

- Acknowledgment of Tax Return Receipt.

- Received Tax Return Form.

- Invoice Notice for Payment.

Furthermore, FAI offers you the ability to prepare your tax return and archive it in the system, allowing you to efficiently manage your tax obligations!

Capital assets are defined as tangible and intangible assets that are part of a business’s assets and are intended for long-term use as a tool or investment.

Generally, owning capital assets aims to generate revenues for the entity.

However, there are several categories that belong to the property subject to taxation, and they are part of the business activity assets, but they are not considered capital assets, such as:

- Inventory: Goods traded.

- Raw materials used in manufacturing and production.

- Consumables.

- Low-value items such as office supplies.

Legislation exempts damaged, stolen, or lost goods from taxation, as they are deemed hypothetical supplies and are therefore not subject to value-added tax, provided they meet the conditions and requirements set by the authority.

The authority may request evidence of damage, theft, or loss of goods through a report from the police or a certificate from the insurance company.

The executive regulations of the Value Added Tax (VAT) system outline a mechanism for correcting errors and specify its conditions, distinguishing between the type of error and its value. When there is an error in the amount owed to the authority in the tax return, the authority’s right to this amount does not expire due to prescription. However, if the error is in favor of the taxpayer, the authority allows a period of 5 years from the end of the calendar year in which the error occurred for correction; otherwise, the taxpayer’s right to correction and refund will be forfeited. There are two types of errors: either an over-declaration or an under-declaration of the due tax.

Over-declaration of the due tax:

If the tax return results in an increase in the amount of tax payable, such as declaring an increase in output tax or a decrease in input tax, the taxpayer may correct the error in any subsequent tax return within the specified adjustment period.

If the error is SAR 5,000 or less, it can be adjusted in the subsequent tax return. However, if the error exceeds SAR 5,000, the taxpayer may make the necessary correction in the next return by adjusting the tax amounts in the fields corresponding to the ones incorrectly filled, by either reducing the output tax or increasing the input tax.

Under-declaration of the due tax:

If the taxpayer discovers that the tax was declared to the authority in an amount less than the tax due, resulting from under-declaring output tax and overstating input tax, they must notify the authority within twenty days of becoming aware of the error or the incorrect amount declared in their original tax return submitted to the authority. This notification can be made by submitting an electronic correction to the previous return for the period associated with the assessments that have been corrected.

To begin with, let’s define Value Added Tax (VAT) as a non-direct tax imposed on goods and services purchased and sold by taxable entities. There are three types of Value Added Tax applied in the Kingdom of Saudi Arabia:

Standard Rate Value Added Tax: 15%

Zero-Rate Value Added Tax: 0%

Exempt Value Added Tax (“Exempt Sales”)

Zero-Rate Tax:

This tax is imposed at a zero rate according to legal provisions, and its rate can be increased at any time without amending the law. Examples include:

Qualified medicines and medical equipment.

Investment metals.

Goods exported outside the Gulf Cooperation Council (GCC) countries.

International transportation services for goods and passengers.

Exempt Tax:

Exempt Value Added Tax (“Exempt Sales”) is an exemption from Value Added Tax for some goods and services provided within the Kingdom of Saudi Arabia. If there is any adjustment to the taxable value of the exempted goods and services, a legal provision is required to modify it to any percentage to which the amendment is made.

Examples of exempted sales from Value Added Tax include:

Life insurance.

Financial services where the consideration is in the form of implicit or explicit margin (e.g., interest on loans).

Issuance or transfer of debt or capital bonds.

Personal luggage and used household items brought in by non-resident citizens or foreigners coming to reside in the country for the first time.

Rental of residential units.

It’s worth noting that any exempt services within the territory of the Kingdom of Saudi Arabia that are exported abroad are subject to a zero-rate. Thus, the supplier or taxpayer has the right to deduct the input tax on these supplies.

For example, providing life insurance services within the Kingdom of Saudi Arabia is exempt from tax, but if this service is provided to a non-resident individual in the Kingdom, it is subject to a zero-rate. (Article 31, Paragraph 2)

In conclusion, one of the most significant differences between zero-rated and exempt VAT is that the zero-rate does not require a legal provision to change its rate, while the exempt VAT requires a legal provision to change it to be subject to VAT regardless of the rate. Additionally, all goods and services subject to the zero-rate can have their input tax deducted, while exempt services and goods cannot.

Deemed supply occurs when a supplier indicates that goods or services have been supplied, even if no consideration has been received for these goods or services. In such cases, the tax is imposed on this deemed supply, even if the taxable person has not received any payment for these goods or services. However, the taxable person does not have the right to waive the state’s right to this tax.

Deemed supply tax is imposed when the taxable person has claimed input tax on these goods or services.

The following actions by the taxable person are considered deemed supplies:

- Disposal of goods for purposes other than business, whether with or without consideration.

- Changing the use of goods to make supplies that are not subject to tax.

- Retaining goods after business activities have ceased.

- Supplying goods without consideration, unless the supply is within the context of business, such as providing samples or low-value gifts.

- Using goods that form part of personal assets for personal use.

- Supplying services without consideration.

If the taxable person has deducted only part of the input tax when purchasing goods and services or when importing goods directly related to any deemed supply, the value of the deemed supply will be adjusted to reflect the relative value of the input tax deducted.

There are also supply scenarios exempted by VAT legislation, which are considered non-deemed supplies and are not subject to tax under the following conditions:

- If a taxable person provides gifts and samples to promote their economic activity, provided that the fair market value of each gift or sample does not exceed SAR 200 (excluding VAT) per person per calendar year. Also, intra-group supplies are ignored, as they are treated as a single entity, and thus, cannot supply to themselves. Therefore, supplies between members of the tax group fall outside the scope of VAT.

- Similarly, if the taxable person provides gifts to their employees, provided that the value of each gift does not exceed SAR 200 (excluding VAT) per person per calendar year, and the total value of gifts and samples for the calendar year does not exceed SAR 50,000 based on the fair market value.

Furthermore, damaged, stolen, or lost goods are exempted from VAT, as they are deemed non-supplies. However, to be exempted, they must meet the conditions set by the authority, and the authority may request a report from the police or an insurance company to prove the damage, theft, or loss.

A tax invoice is defined as a document issued for taxable supplies, according to the requirements stipulated in the regulations.

Previously, tax invoices were manually issued or generated from any software such as Word or Excel. However, the General Authority of Zakat and Tax (GAZT) announced the approval of the Electronic Invoicing Regulation, and the obligation to issue and maintain invoices electronically starting from December 4, 2021.

We will discuss the definition of electronic tax invoices (standard) and simplified electronic invoices, and the difference between them.

- Electronic Tax Invoice (Standard):

- This invoice is issued from one entity to another and contains all the elements of a tax invoice, including:

- Document title: “Tax Invoice” or “Simplified Tax Invoice.”

- Dates: Invoice issuance date and the date of supply if different from the issuance date.

- Serial number of the tax invoice.

- Supplier’s details: Name, address, VAT registration number.

- Customer’s details: Name, address, VAT registration number.

- Details of the supply: Must be in Arabic; other languages are allowed alongside Arabic.

- Total amount before VAT.

- VAT rate.

- Total amount after VAT.

- Simplified Tax Invoice:

- This invoice is issued for supplies subject to VAT in specific cases and contains fewer details compared to the standard tax invoice.

- It is usually issued from an entity to an individual (non-taxable persons) and must contain a Quick Response (QR) Code.

- Note that it has become mandatory to apply the QR Code on standard tax invoices starting from January 1, 2023, which is the second phase of electronic invoicing.

These tax invoices ensure compliance with VAT regulations and facilitate the process of taxation and financial record-keeping for businesses.

If you are a taxpayer subject to value-added tax (VAT), you must know what obligations and conditions you are required to comply with. Here are the most important obligations stipulated in the regulations:

-

- Issuing Invoices:

- Every person subject to VAT must issue a tax invoice, whether it’s a simplified invoice or a full invoice, for every taxable supply to both taxable and non-taxable persons. Invoices must be issued according to the requirements set by the authority. (Article 53)

- Submitting VAT Returns:

- Every registered person for VAT purposes, and anyone representing a VAT taxpayer, must submit their tax return for supplies and expenses during the tax period, whether monthly or quarterly (every three months).

- The tax return is a self-assessment by the person for their supplies and expenses, determining the amount they owe or are owed by the authority, and refund requests can be made within five years.

- The return must be submitted and the tax paid by the last day of the month following the end of the tax period. (Article 62)

- Maintaining Records:

- All persons subject to VAT must keep tax records related to calculating VAT for auditing purposes and for inspection and review by authority employees if necessary. This includes any documents used to determine the VAT amount for each tax return.

- Records must be kept for the basic retention period of six years. (Article 66)

- Displaying VAT Registration Certificate:

- A person subject to VAT and registered with the authority in the VAT system must display their registration certificate at their main place of business and all branches where it is visible to the public. (Article 8-8)

- Correcting Previous Errors:

- If a taxpayer discovers an error in their tax return, the incorrectness of the amount stated in the return, or a failure to comply with any tax obligation, they must inform the authority and correct the error by amending the tax return.

- If the error results in a tax difference of more than SAR 15,000, the taxpayer must inform the authority within 20 days of discovering the error and amend the previous return.

- If it’s less than SAR 15,000, the error can be corrected by adjusting the net tax in the previous return. (Article 63)

- Issuing Invoices:

The taxpayer responsible for withholding tax must register with the authority and submit a monthly withholding statement. They must submit the monthly statement and pay the withheld amount during the first ten days of the month following the payment month to the beneficiary.

For example: If a resident pays a fee to a non-resident on February 19th, the person responsible for withholding tax must submit a statement to the authority and pay the withheld tax by March 10th. They must also provide the beneficiary with a certificate showing the amount paid to them and the tax withheld from it.

In addition to the monthly withholding statement and tax payment, the taxpayer must submit an annual statement within a deadline not exceeding 120 days from the end of the fiscal year.

Tax is withheld on each type of income at a specific rate determined by the authority, and the taxpayer must specify the type of income in order to determine the tax withholding rate.

Many establishments resident in Saudi Arabia often seek services from companies or individuals outside the Kingdom, whether these services are consultancy, technical, or engineering. When these services are requested from non-residents, they may be subject to withholding tax by the Zakat, Tax, and Customs Authority.

Withholding tax, also known as retention tax, is a direct tax determined at certain rates and applied to non-residents in Saudi Arabia. It is deducted from amounts they receive from a source within the Kingdom. Withholding tax rates in Saudi Arabia range between 5 and 20 percent.

Who is responsible for withholding tax?

The person responsible is defined as any individual residing in Saudi Arabia, whether taxable or non-taxable, or a permanent establishment for non-residents who pays amounts from sources within the Kingdom to non-residents. Thus, they are responsible for remitting the withholding tax amount to the authority.

As for the resident natural person, they are only obligated to withhold tax in cases where they pay an amount from a source within the Kingdom for services provided by a non-resident for the purposes of their economic activity.

Tax periods depend on the annual supplies of the taxpayer. The tax period for individuals subject to Value Added Tax (VAT) whose annual taxable supplies exceed 40 million Saudi Riyals over the preceding twelve months is monthly, while for others, it is quarterly every three months.

A taxpayer whose annual supplies do not exceed 40 million Saudi Riyals may apply to the authority to use a monthly tax period, and the authority may approve or reject it.

Similarly, a person who has used the monthly period for two years may apply to the authority to use a quarterly tax period, provided that the value of their supplies during the year does not exceed 40 million Saudi Riyals at the time of application.

A person using the monthly period submits their first return to the authority at the end of the month following the month of supply. For example, they would submit the tax return for January on February 28.

As for a person using the quarterly period, they submit their first return to the authority on the last day of the month following the three-month period of supply. For example, they would submit the tax return for the first quarter of the year on April 30.

If you are a natural or legal person, engaged in economic activity, and conduct your activity on a continuous and regular basis with the aim of generating income, then you are subject to the regulations and legislation of Value Added Tax (VAT) in Saudi Arabia. There are two types of registration: mandatory and optional.

Optional Registration:

The legislation allows individuals or entities whose supplies or expenses in the past twelve months or expected in the next twelve months exceed 375,000 Saudi Riyals, with an increase of more than 187,500 Saudi Riyals, to optionally register for VAT purposes. Also, those whose supplies consist entirely of zero-rated items are allowed to register optionally. The registration becomes effective from the date of acceptance of the registration application by the authority.

Mandatory Registration:

Registration becomes mandatory for anyone who supplies goods and services subject to VAT, provided that their supplies of taxable goods or services during the past twelve months or expected in the next twelve months reach the mandatory registration threshold of 375,000 Saudi Riyals. Registration must be done within 30 days from the end of the month in which the supplies reach the mandatory threshold, and the registration becomes effective from the beginning of the first month in which the supplies are expected to exceed the mandatory registration threshold.

Need More Help?

We are here to help you! If you didn’t find an answer to your question, use the help box below

Sending

Sending